Quarterly Report Q1 2024

Jones Industrial Team / April 30, 2024

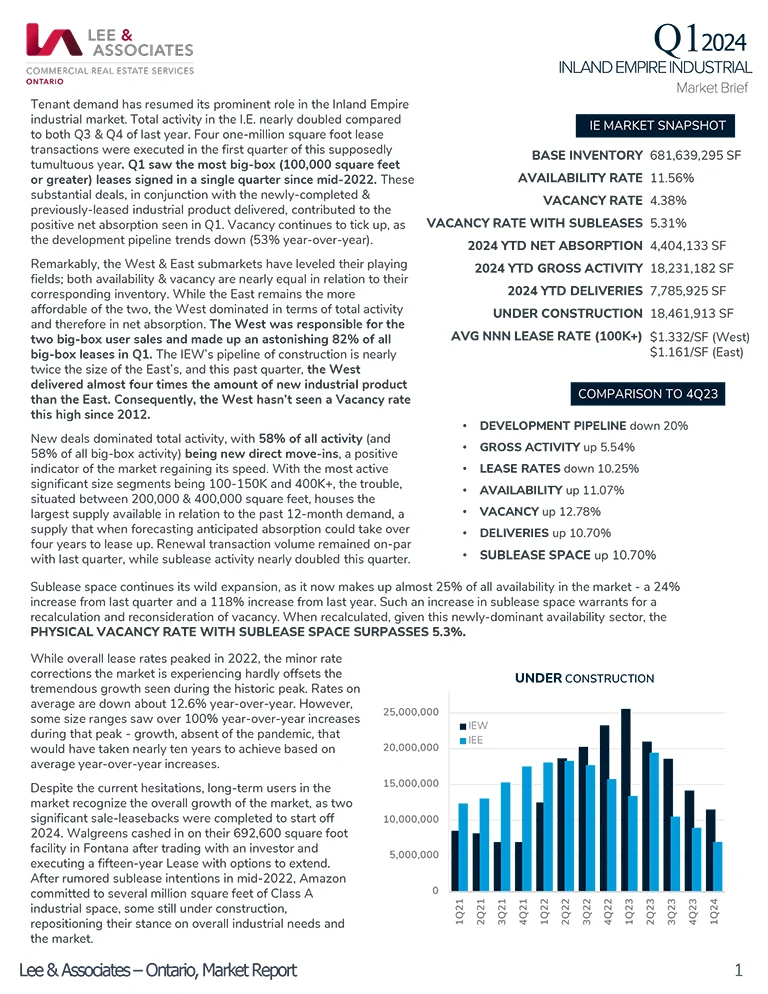

Tenant demand has resumed its prominent role in the Inland Empire industrial market. Total activity in the I.E. nearly doubled compared to both Q3 & Q4 of last year. Four one-million square foot lease transactions were executed in the first quarter of this supposedly tumultuous year. Q1 saw the most big-box (100,000 square feet or greater) leases signed in a single quarter since mid-2022. These substantial deals, in conjunction with the newly-completed & previously-leased industrial product delivered, contributed to the positive net absorption seen in Q1. Vacancy continues to tick up, as the development pipeline trends down (53% year-over-year).

Remarkably, the West & East submarkets have leveled their playing fields; both availability & vacancy are nearly equal in relation to their corresponding inventory. While the East remains the more affordable of the two, the West dominated in terms of total activity and therefore in net absorption. The West was responsible for the two big-box user sales and made up an astonishing 82% of all big-box leases in Q1. The IEW’s pipeline of construction is nearly twice the size of the East’s, and this past quarter, the West delivered almost four times the amount of new industrial product than the East. Consequently, the West hasn’t seen a Vacancy rate this high since 2012.

Download Quarterly Report Q1 2024« Previous

Receive New Listing Alerts and Off Market Deals

Established in 1987, Lee & Associates – Ontario has been the highest producing and grossing Lee & Associates office in the country for the last 10 years consecutively, as well as one of the highest grossing commercial real estate firms in the country annually. Since its inception, the Jones Industrial Team has consistently ranked among the top producing teams, contributing to the overall success and reputation of the firm.

Sign up with your email address to receive notifications about our team’s new listings and exclusive off-market investment opportunities.